The Ultimate Guide To Estate Planning Attorney

10 Easy Facts About Estate Planning Attorney Shown

Table of ContentsAbout Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedEstate Planning Attorney for DummiesThe Of Estate Planning Attorney

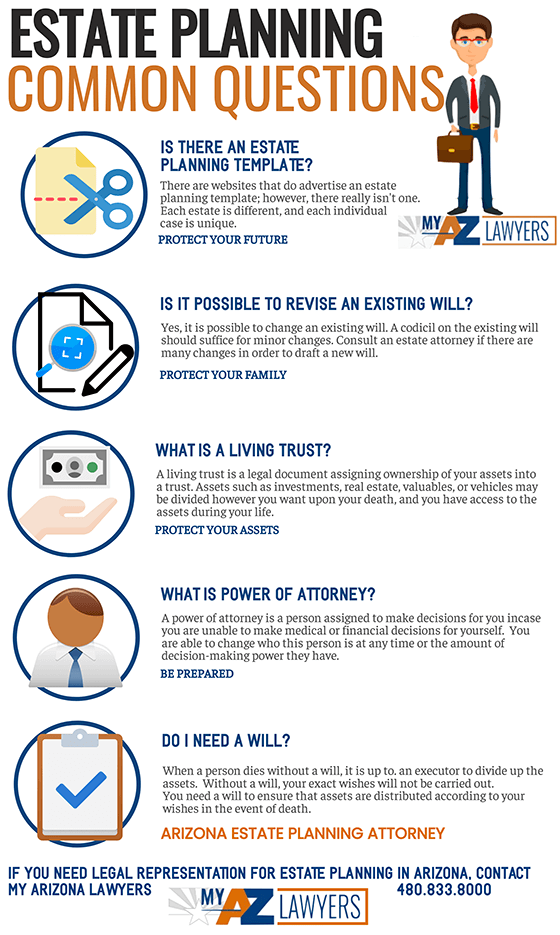

Your lawyer will also aid you make your documents official, preparing for witnesses and notary public trademarks as needed, so you don't have to fret about attempting to do that final action on your very own - Estate Planning Attorney. Last, however not the very least, there is useful comfort in developing a connection with an estate preparation attorney that can be there for you in the futureBasically, estate preparation lawyers offer value in numerous ways, much beyond merely giving you with published wills, trusts, or other estate preparing records. If you have questions concerning the procedure and intend to discover more, contact our workplace today.

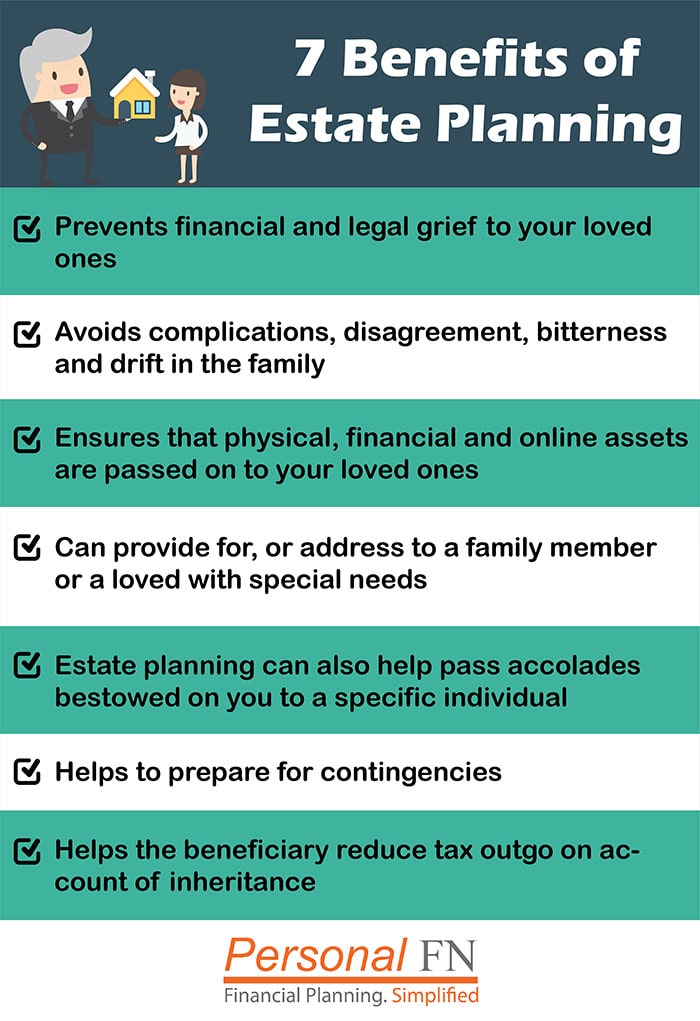

An estate preparation attorney helps you formalize end-of-life choices and lawful files. They can establish wills, develop trust funds, develop health and wellness care instructions, establish power of attorney, develop sequence strategies, and much more, according to your wishes. Dealing with an estate planning attorney to finish and oversee this lawful documentation can help you in the adhering to eight locations: Estate preparing attorneys are specialists in your state's trust fund, probate, and tax obligation regulations.

If you do not have a will, the state can determine exactly how to separate your possessions among your heirs, which might not be according to your desires. An estate preparation attorney can aid organize all your legal files and disperse your assets as you want, potentially preventing probate.

Some Of Estate Planning Attorney

Once a customer passes away, an estate plan would dictate the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices might be delegated the near relative or the state. Tasks of estate organizers include: Producing a last will and testament Establishing trust accounts Naming an administrator and power of attorneys Determining all beneficiaries Calling a guardian for small kids Paying all financial obligations and decreasing all tax obligations and legal charges Crafting instructions for passing your worths Developing choices for funeral plans Completing instructions for care if you come to be sick and are incapable to make decisions Acquiring life insurance policy, disability earnings insurance policy, and long-lasting care insurance policy A good estate plan should be upgraded on a regular basis as clients' economic scenarios, individual inspirations, and government and state legislations all evolve

Similar to any profession, there are characteristics and abilities that can assist you attain these objectives as you work with your customers in an estate coordinator role. An estate planning occupation can be appropriate for you if you have the following qualities: Being an estate organizer indicates thinking in the long-term.

Estate Planning Attorney Fundamentals Explained

You have to assist your customer anticipate his or her end of life and what will take place postmortem, while at the same time not dwelling on morbid thoughts or feelings. Some customers might end up being bitter or distraught when considering death and it could drop to you to aid them through it.

In the event of death, you may be expected to have many conversations and transactions with enduring household members regarding the estate strategy. In order to excel as an estate coordinator, you may require to stroll a fine line of being a shoulder to lean on and the individual relied on to connect estate planning matters in a prompt and expert manner.

tax obligation code transformed thousands of times in the ten years between 2001 and 2012. Expect that it has actually been changed further ever since. Relying on your customer's economic earnings brace, which may progress towards end-of-life, you as an estate coordinator will certainly have to keep your customer's assets completely legal conformity with any local, federal, or worldwide tax obligation legislations.

The 3-Minute Rule for Estate Planning Attorney

Acquiring this accreditation from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these expert teams can verify your abilities, making you more eye-catching in the eyes of a possible customer. Along with the psychological benefit of helping this contact form customers with end-of-life planning, estate coordinators take pleasure in the benefits of a stable revenue.

Estate preparation is a smart thing to do despite your present health and wellness and financial condition. However, not numerous people recognize where to start the procedure. The very first important point is to employ an estate planning attorney to aid you with it. The following are 5 benefits of working with Clicking Here an estate preparation lawyer.

The portion of individuals that do not recognize exactly how to get a will has enhanced from 4% to 7.6% considering that 2017. An experienced lawyer knows what info to consist of in the will, including your recipients and special factors to consider. A will safeguards your household from loss as a result of immaturity or disqualification. It also offers the swiftest and most efficient approach to move your assets additional reading to your recipients.